Stop-Loss

Everything you need to know about Stop-Loss

Automated Stop-Loss is a product offered by Summer.fi that allows you to prevent liquidations on your Vaults if the collateralization ratio falls too low.

Stop-Loss protection is currently available for Maker, Aave v3, and Spark positions.

What happens once Stop-Loss has been triggered?

Automated Stop-Loss is a product offered by Summer.fi that allows you to prevent liquidations on your Vaults if the collateralization ratio falls too low.

You can set the minimum collateralization ratio you're willing to accept on your Vault, and if your Vault's ratio is at or below this level, a Stop-Loss action is triggered. You can configure this action to close your Vault to collateral or to Dai, therefore preventing further losses if the collateral price goes down.

Once you configure the minimum collateralization ratio and the asset to be received when the protection is triggered, you will need to send a transaction to allow the automation smart contracts to interact with your Vault, and to enable the feature with the selected parameters.

From then on, Keepers (incentivized automated or human actors) start monitoring the next OSM price and your vault's parameters. If the Stop-Loss condition is met for the next price oracle update, any Keeper can execute the trigger function in the automation contracts and call the "Close Vault" action on the Vault.

These transactions are sent to a Flashbots node to prevent any front-running.

The flow diagram in the figure shows the sequence of events when the protection is triggered.

Figure 1: Stop-Loss protection flow chart

What are the risks associated with Stop-Loss protection?

Automated Stop-Loss protection is a tool that depends on certain conditions to work correctly. Some risks may make the protection fail or work differently than expected. You, as the user of the feature, should be aware of these risks:

Keepers are centralized: Keepers are the actors that react to OSM price variations and start the vault closing process by sending a transaction to the network. If for any reason, the Keepers fail, or are unable to send the transactions, your Automated Stop-Loss might not work as expected.

Gas costs can spike: In moments of high volatility, there are usually a high amount of transactions waiting to be mined. This congests the network, and the gas price needed for a transaction to be processed in the next block increases. If a Keeper sends a transaction with low gas price, it might be queued for some time until it is finally mined.

The exchange might face liquidity issues: To unlock your collateral in the event of protection triggering, the Automation Smart Contracts take a flash loan to cover your vault’s debt, and then swap part of your unlocked collateral to pay the flash loan back. These actions are routed through a decentralized exchange that might temporarily have liquidity issues for the loan or the swap. In these cases, the transaction can be more expensive than the predicted value, or fail completely.

The price oracle can fail: Maker OSM module delays the propagation of the collateral’s next price for one hour. This means that if a malicious actor tries to manipulate the next price, there is time to react to the attack and revert to a valid value. If, during an attack, the Keepers take the incorrect value as truth, they might be tricked into triggering the stop loss protection incorrectly, or not triggering it at all.

Smart Contracts related to the Automated Stop-loss protection could be paused: in case an issue is found, Summer.fi does have the power to disable the Automaton-related Smart Contracts. Please note that this would not impact your ability to manually redeem collateral or adjust your vault.

Why can't I set a target price instead of a collateralization ratio?

Automated Stop-Loss applies to Vaults that can be adjusted anytime and accrue stability fees over time. Setting a target liquidation price means that it must be reconfigured every time you adjust your vault’s collateral and debt.

To prevent this, you set your target collateralization ratio independent of the current vault's debt or multiple factors and not affected by the stability fees.

Are there any fees or costs associated with the Automated Stop-Loss feature?

There are no recurring or additional costs associated with protecting your Vault, compared to a non-protected Multiply Vault. As with any other Ethereum transaction, a gas cost is associated with the vault being closed and the Stop-Loss being triggered.

The stop-loss trigger is performed by Keepers, externally owned accounts (EOA) not associated with the Vault's owner. The gas costs incurred by these actors is reimbursed, and paid from the Vault's funds (either collateral or Dai).When you configure your Vault’s Stop-Loss protection, you can see a detail of all fees charged to the vault closing transaction.

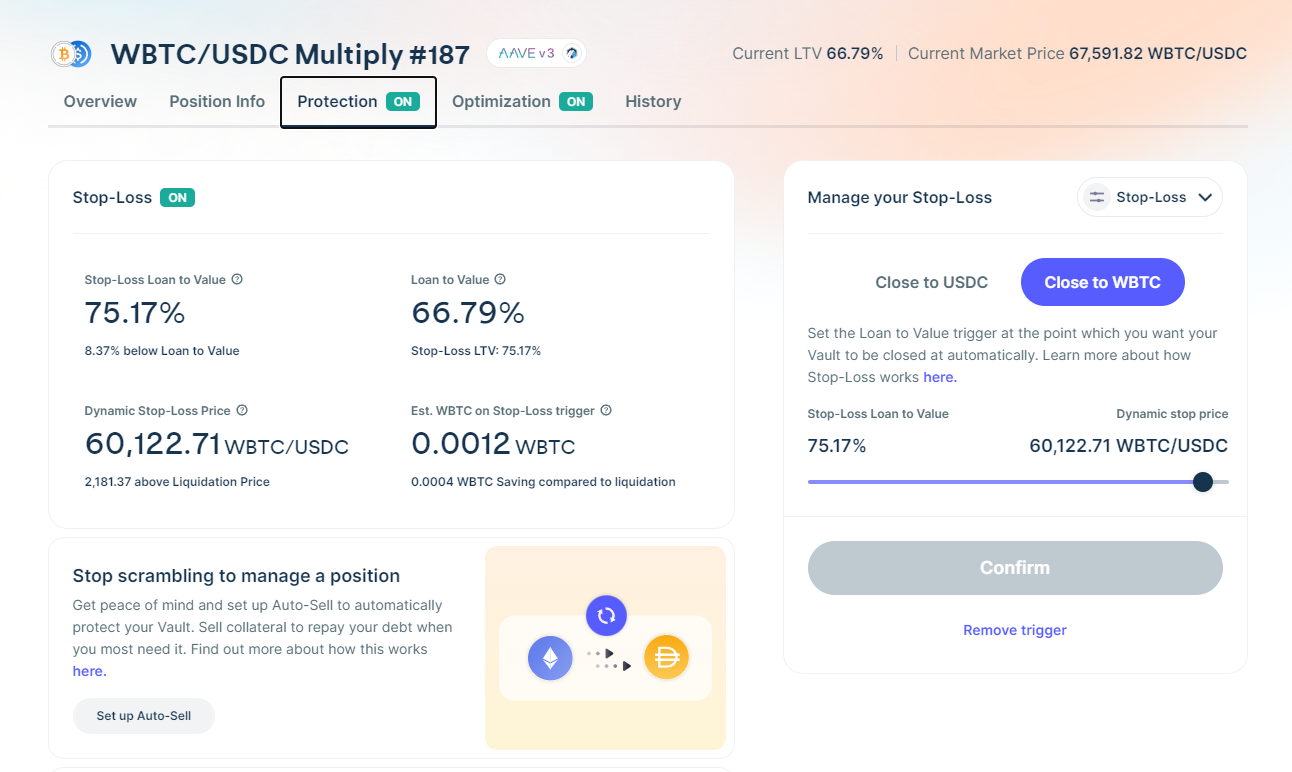

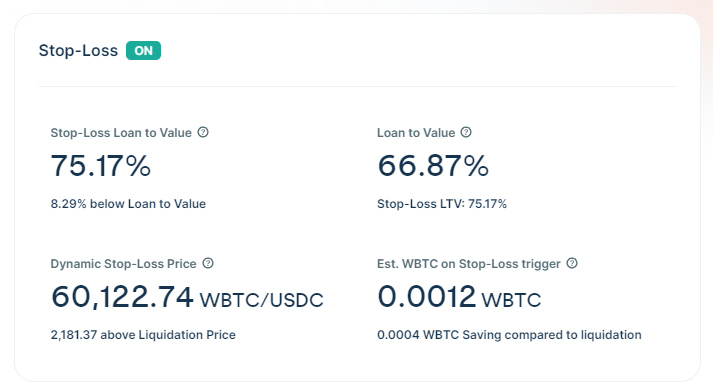

Once the protection is set up, you can see at any time the approximate amount of assets you will receive when the Stop-Loss protection is triggered. This value takes into account all fees and costs.

How can I disable or adjust the Stop-Loss protection parameters?

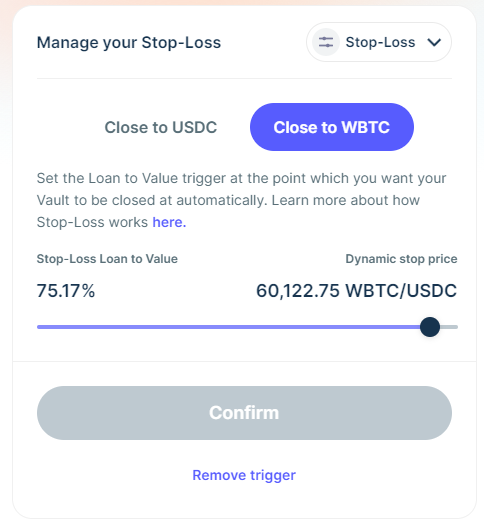

You can access the Automated Stop-Loss configuration by clicking in the "Protection" tab in your vault's page.

In that page you can modify the Stop-Loss Collateralization Ratio, the asset received, or you can disable all protections completely by clicking on the "Cancel downside protection" button.

Any modifications to the state of the Automated Stop-Loss or its parameters will require you to send a transaction, and will incur in gas costs.

What price is used to trigger and calculate my Stop-Loss?

There are two collateral prices involved in a Stop-Loss trigger.

The collateral price used for the trigger itself, shown in the Vault protection page as the Dynamic Stop Price, is compared to the next price for the collateral as informed by Maker OSM. If the next price of the collateral is below the Dynamic Stop price, the Stop-Loss protection is triggered.

If your choice is to close your position to Dai, the collateral price used to calculate the Dai sent to your wallet when the protection is triggered is the market price of the collateral in the moment of the Stop-Loss protection. The swap from your collateral to Dai is routed through 1inch decentralized exchange.

How much of my assets will I get back if the Stop-Loss protection is triggered?

You can see an approximate amount of assets you will receive on stop loss trigger in the box shown in Figure 1

Figure 1: Estimated amount of assets to receive when the protection is triggered

It is very difficult to calculate the exact amount as it depends on several factors at the time of the Stop-Loss trigger. These factors include market price, available liquidity and gas costs. The calculation shown assumes a 2% difference from Trigger Price to Market Price.

The amount saved compared to liquidation is based on the assumption of not paying a Liquidation Penalty, currently set to 13.00%.

Was this helpful?