Trailing Stop-Loss

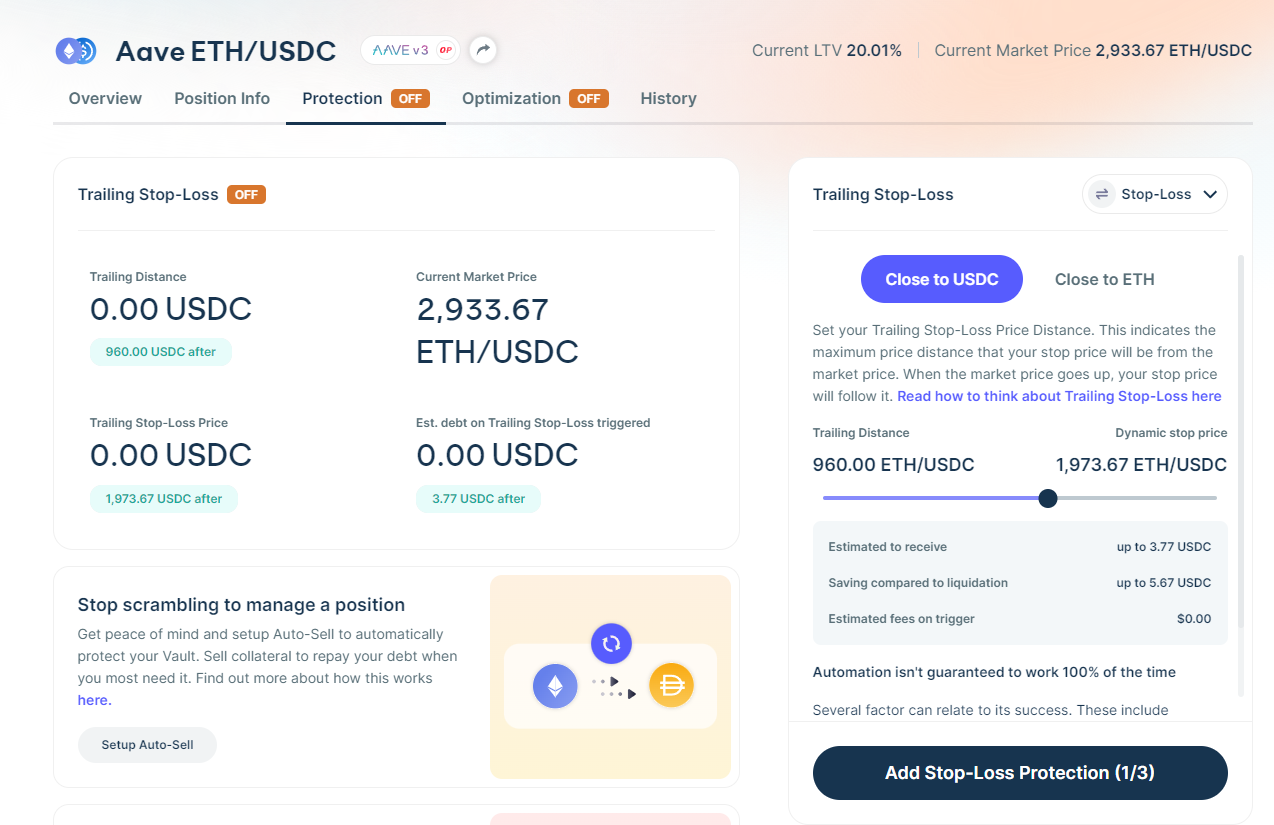

Available for all Aave positions on all networks

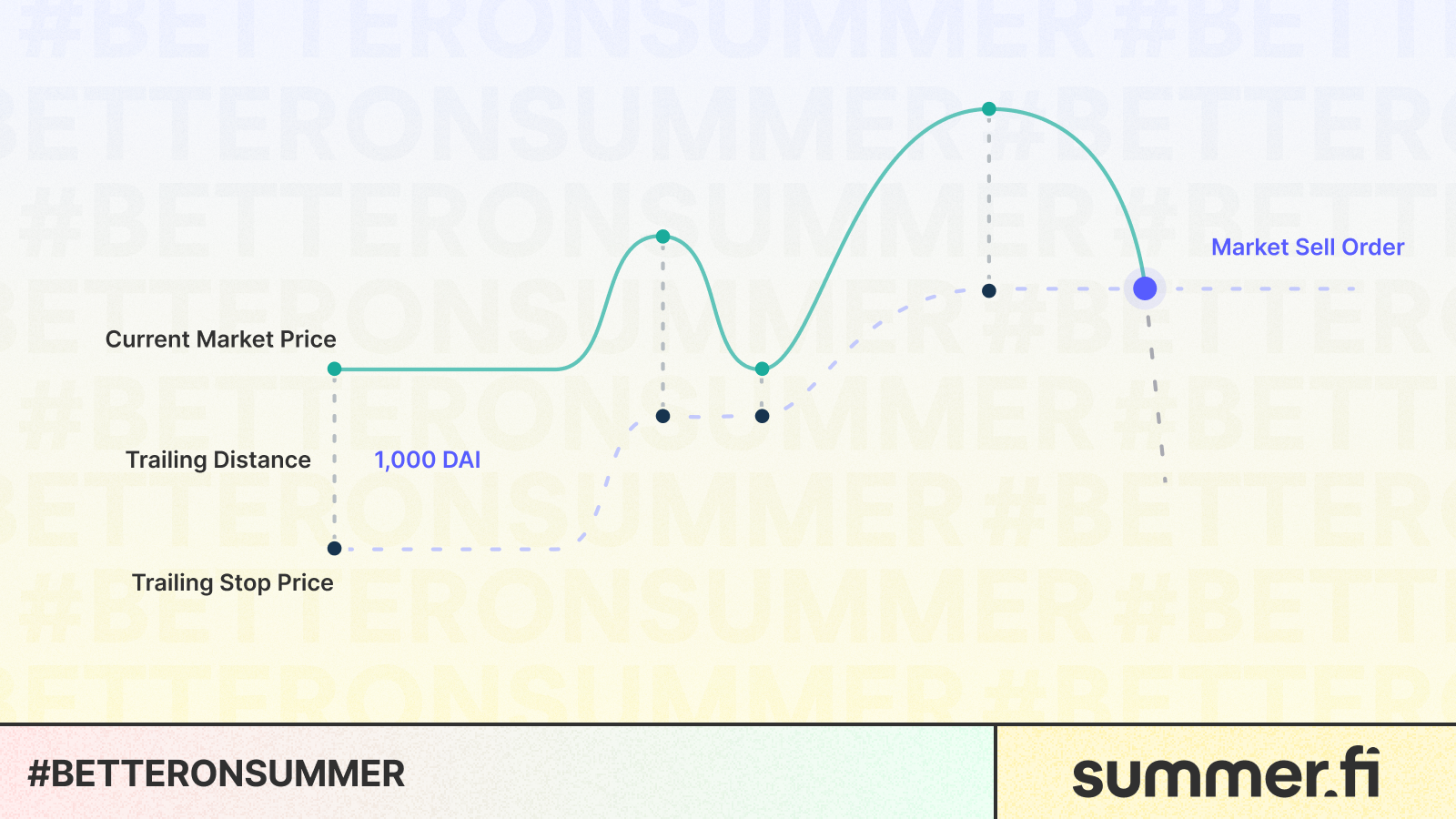

A Trailing Stop Loss is an automated order to protect gains and limit losses. It sets a stop order at a specific percentage or dollar amount away from an asset's market price. As the asset price increases, the stop order trails along, moving up. Conversely, if the price decreases, the stop order remains stationary. This ensures that the position remains open if the price moves in the user's favour, automatically closing if the market changes direction by the set percentage or amount.

Essentially, a Trailing Stop Loss locks in profits while mitigating potential losses, providing an important risk management tool for investors.

Setting up a Trailing Stop-Loss

You only choose a trailing distance

Example: For ETH/USDC this could be 100 ETH/USDC

This distance determines the starting trailing stop price which is:

Current market price - Trailing distance

Example:

Current market price is 2000 ETH/USDC

Trailing distance is 100 ETH/USDC

Current Trailing stop loss price is therefore at 1900 ETH/USDC

Changes in the Trailing Stop Price

If the market price increases to higher than the market price when you initially set-up your trailing stop loss, then the price at which your trailing stop loss will be executed is also increasing. However, when the price then decreases, your trailing stop will stay as it was, based on the highest price.

For example:

Day 1: set-up:

Current market price is 2000 ETH/USDC

Trailing distance is 100 ETH/USDC

Current Trailing stop loss price is therefore at 1900 ETH/USDC

Day 2: price increase:

Highest reached market price is 2200 ETH/USDC

Current Trailing stop loss price is therefore increased to 2100 ETH/USDC

Day 3: price decrease:

Lowest reached market price is 2150 ETH/USDC

As this is higher than the trailing stop price, it stays at 2100 ETH/USDC

Day 4: price increase:

Highest reached market price is 2300 ETH/USDC

Current Trailing stop loss price is therefore increased to 2200 ETH/USDC

Day 5: price decrease:

Current market price reaches below 2200 ETH/USDC

Your trailing stop loss gets executed as a market sell order.

If between signing and submitting the Trailing Stop Loss set-up transaction and execution and inclusion of it happens a Chainlink price update of one of the tokens in your pair, then your set-up/update transaction will revert. This is a protection to ensure that trailing stop loss is fully non-custodial.

Was this helpful?